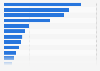

Largest banks in the U.S. 2024, by number of branches

As of March 2024, JPMorgan Chase Bank was the largest bank in the United States by the number of branches, with 5,110 branches nationwide. It was followed by Wells Fargo Bank, which operated 4,349 branches, and Bank of America, with 3,975 branches. For context, Wells Fargo had approximately three times the number of branches as Lloyds Bank, the leading British bank by branch count.

Is the U.S. banking sector stable?

The stability of the U.S. banking sector has improved steadily since the aftermath of the 2008 financial crisis. The share of non-performing loans held by U.S. banks has consistently decreased over time. As of the first quarter of 2024, all four of the largest U.S. banks—Wells Fargo, JPMorgan Chase, Bank of America, and Citigroup—maintained a Common Equity Tier 1 (CET1) capital ratio well above the Basel-III minimum requirement of 4.5 percent. The CET1 capital ratio, which measures a bank’s core capital against its risk-weighted assets, is a key indicator of a bank's financial strength and resilience.

Digital banking in the U.S.

With the rise of digital services, many traditional banking functions can now be performed online, reducing the need for a physical presence. Since 2009, the number of bank branches in the United States has steadily declined as consumers increasingly rely on digital banking solutions. This trend accelerated during the COVID-19 pandemic, with more Americans turning to online banking for convenience and cost-effectiveness.